44+ how does the fed rate affect mortgage rates

If the Fed raises rates that means mortgages will be more expensive making buying a house less appealing for many. Web 1 day agoThe average rate on the popular 30-year fixed mortgage dropped to 657 on Monday according to Mortgage News Daily.

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Web Theres no correlation between the Fed raising rates and mortgage rates.

. Our Trusted Reviews Help You Make A More Informed Refi Decision. Web The Fed is trying to get inflation under control. Get Your Best Mortgage Option with PenFed.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Let PenFed Bring You Home with Confidence. Instead it determines the federal funds rate which generally impacts short-term and variable adjustable interest.

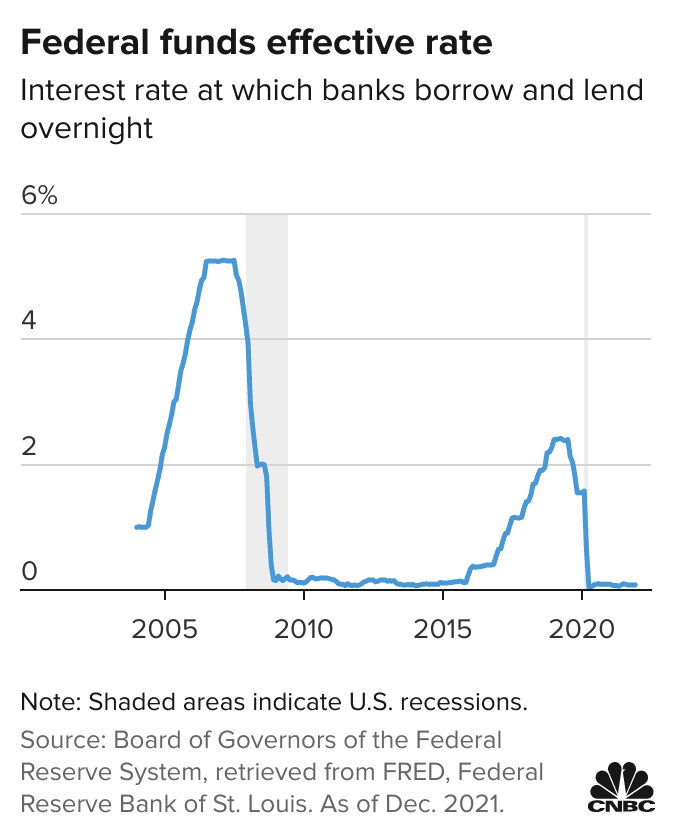

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. The federal funds rate is a tool that the Fed uses to influence inflation.

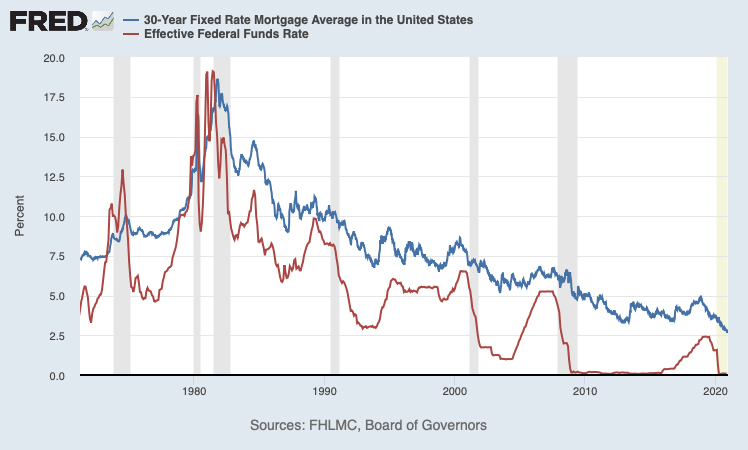

Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac. The Fed Funds Rate is ill-suited for such a task because its a blunt. Our Trusted Reviews Help You Make A More Informed Refi Decision.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web But with mortgage rates pulling back affordability is less of a factor. Web How mortgage rates have changed over time.

17 mortgage rates ticked up to 416. Web 1 day agoThe average rate for a 15-year fixed mortgage is 628 which is a decrease of 5 basis points compared to a week ago. Get Your Best Mortgage Option with PenFed.

Web Silicon Valley Bank stumbled due to a mismatch of assets and liabilities a mistake reminiscent of the thrift crisis of the 1970s. 26 FOMC meeting that it will soon be appropriate to raise the target range for the. Web The fed funds rate and mortgage rates.

Web How do Fed rate changes affect the price of houses. Web 1 day agoIt said the US central bank would probably raise rates by 025 percentage points in May June and July as it sought to counter high levels of inflation before a peak in. With a Low Down Payment Option You Could Buy Your Own Home.

Ad Why Rent When You Could Own. Ad Let PenFed Bring You Home with Confidence. Web Still mortgage rates have more than doubled since the beginning of the year.

A 500000 30-year fixed mortgage at a 7 interest rate translates to a monthly. This is because the Federal. With a Low Down Payment Option You Could Buy Your Own Home.

Thats down from a rate of 676 on Friday. Youll definitely have a higher monthly payment. In June inflation reached a 41-year highInflation.

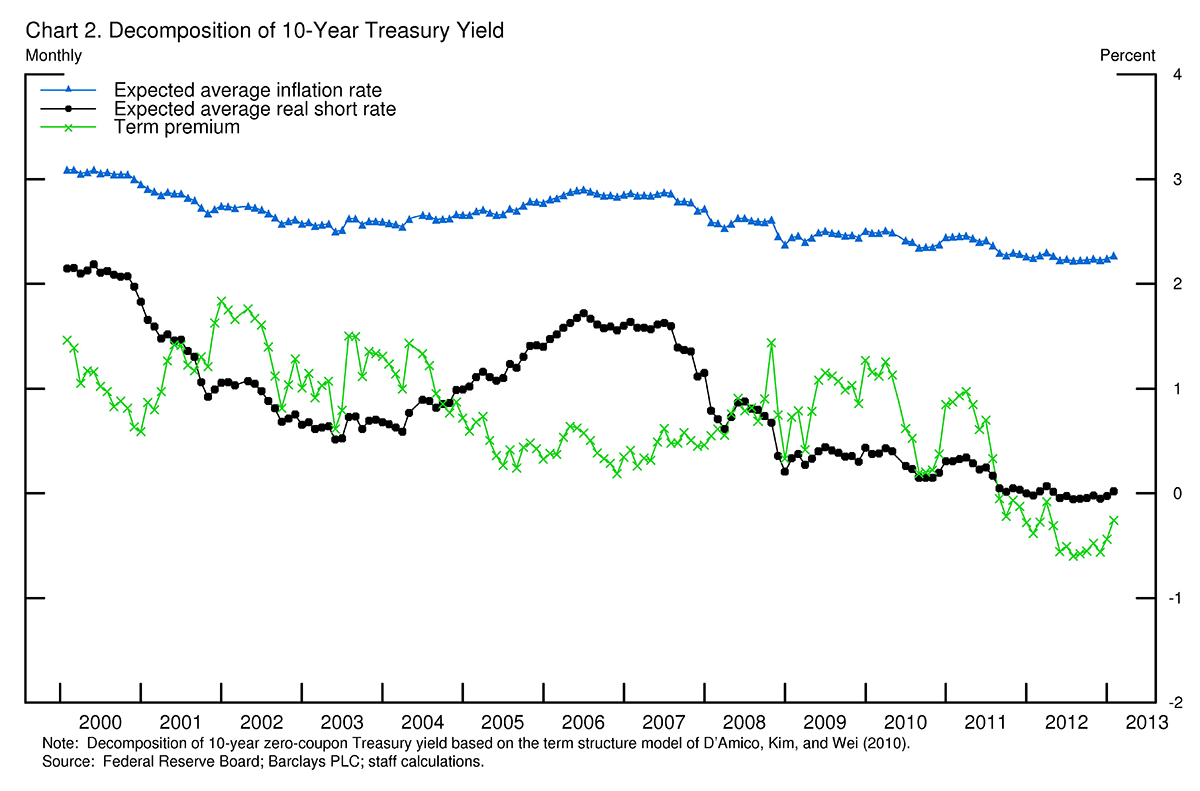

The prime rate will rise by a quarter of a percentage point to 775. Web 1 day agoAfter reaching the 7 mark in early February the 30-year fixed-rate conventional mortgage is trading at 657 on Monday morning according to Mortgage. Web The Federal Reserve influences mortgage rates by changing how Wall Street views the future.

Web The Fed doesnt actually set mortgage rates. Much of this has to do with higher long-dated bond. Web In addition to the actions it takes with the federal funds rate the Federal Reserve has a much bigger impact on mortgage rates.

For instance borrowing 320000 at last years peak rate of 712 percent translated to a. Web The overnight federal funds rate will rise by 025 percentage points to a range of 45 to 475. Additionally the Fed confirmed at its Jan.

Web 1 day agoThe Fed has been hiking interest rates for about a year in an attempt to tamp down inflation and those hikes have been weighing on the price of financial assets like. Web For the week ended Mar. Web The Feds actions do indirectly influence the rates consumers pay on their fixed-rate home loans when they refinance or take out a new mortgage.

Web When the Feds policy body the Federal Open Market Committee or FOMC changes the federal funds rate that has a direct effect on many variable-rate consumer. Here is a chart showing the rates of a 30-year fixed mortgage before and after each. This compares to 309 one year ago.

How Does The Fed Rate Affect Mortgage Rates

How The Fed S Rate Decisions Move Mortgage Rates Bankrate

How Does The Fed Rate Affect Mortgage Rates Discover

How Does The Fed Rate Affect Mortgage Rates Yoreevo

![]()

How The Federal Reserve Affects Mortgage Rates Nerdwallet

How Will The Fed Interest Rate Hike Affect You Los Angeles Times

Here S What The Fed S Rate Hike Means For Borrowers Savers

What Does The Latest Fed Rate Hike Mean For Mortgage Rates

Bernanke On Long Term Interest Rates Econbrowser

Fed Raises Interest Rates Remains On Track To Keep Tightening Wsj

Mortgage Rates Vs Fed Announcements

Federal Reserve Cuts Interest Rates For Third Time In 2019 The New York Times

How The Fed S Interest Rate Hike Impacts Mortgage Rates Fortune Recommends

How Will The Fed Interest Rate Hike Affect You Los Angeles Times

How The Federal Reserve Affects Mortgage Rates Nerdwallet

:max_bytes(150000):strip_icc()/picture-53712-1421087725-5bfc2a93c9e77c0026b4cc1f.jpg)

How The Federal Reserve Affects Mortgage Rates

What Is Neutral Monetary Policy Sf Fed